Cheyenne Credit Unions: Discover Top Financial Solutions in Your Location

Cheyenne Credit Unions: Discover Top Financial Solutions in Your Location

Blog Article

Elevate Your Banking Experience With a Federal Credit Rating Union

Federal Debt Unions supply an unique technique to financial that focuses on member complete satisfaction and financial wellness. By discovering the advantages of signing up with a Federal Credit Union, people can boost their banking experience and take benefit of opportunities not commonly discovered in conventional financial institutions.

Benefits of Signing Up With a Federal Credit History Union

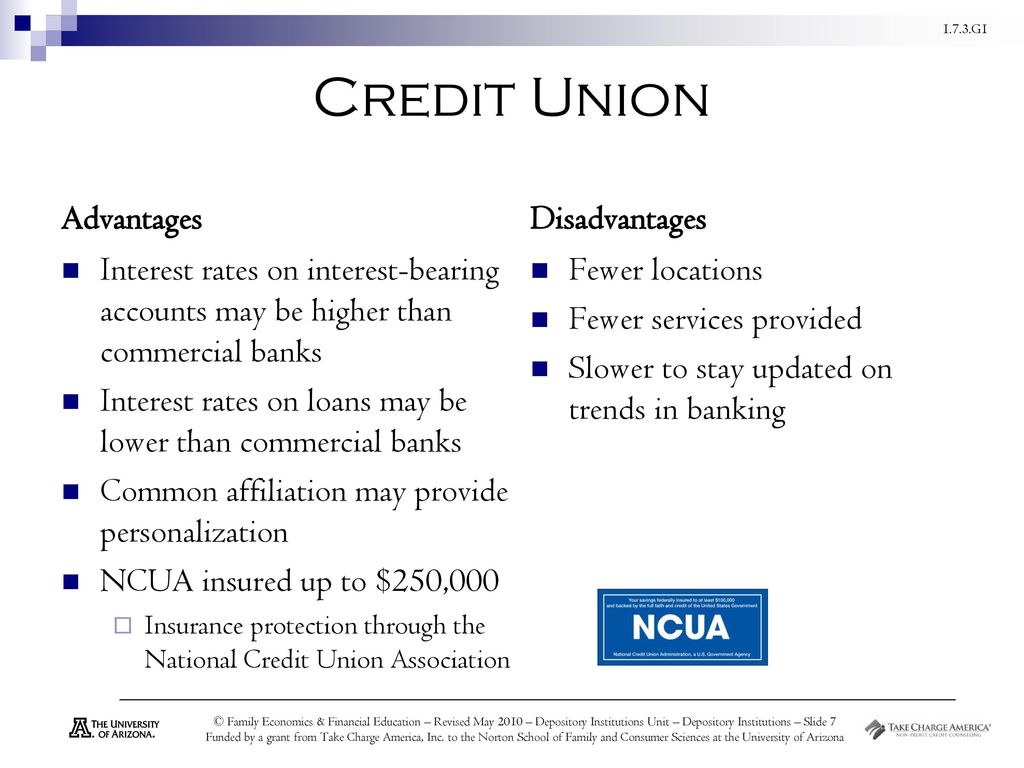

Joining a Federal Cooperative credit union provides various benefits for people seeking a much more tailored and community-oriented method to financial solutions. One essential advantage is generally reduced fees compared to standard financial institutions. Federal Lending institution are not-for-profit companies, so they usually have lower expenses costs, enabling them to provide far better rates on loans, greater interest prices on cost savings accounts, and minimized charges for solutions such as over-limits or ATM withdrawals.

Additionally, Federal Credit Unions prioritize their members' financial health over making the most of earnings. This implies they are most likely to function with members encountering financial troubles, offering options like flexible payment strategies or financial therapy. Members likewise have a voice in exactly how the cooperative credit union is run, as they can elect on essential choices and elect board members.

Moreover, Federal Cooperative credit union commonly offer a more customized experience, with staff who recognize their participants by name and recognize their unique financial goals (Cheyenne Credit Unions). This tailored approach can result in much better customer solution, customized financial suggestions, and a sense of coming from a community-focused banks

Customized Customer Care

Experiencing tailored client solution at a Federal Credit score Union improves the general financial partnership for participants. Unlike typical financial institutions, Federal Cooperative credit union prioritize constructing strong connections with their participants by supplying tailored assistance tailored to specific monetary needs. When you walk into a Federal Lending Institution, you are a lot more than just an account number; you are a valued participant of a community-focused economic institution.

One of the key benefits of tailored customer support is the attention to detail that participants receive. Whether you are consulting on monetary preparation, looking for a financing, or merely have a question regarding your account, Federal Lending institution staff are dedicated to supplying mindful and tailored assistance every action of the way. This level of treatment aids cultivate trust fund and commitment in between members and their lending institution, creating a much more favorable and enjoyable banking experience generally.

Competitive Prices and Charges

When thinking about banking choices, the element of Affordable Rates and Costs plays an essential duty in establishing the financial benefits for participants. Federal cooperative credit union are understood for offering competitive rates and fees compared to typical financial institutions. Participants frequently gain from higher rate of interest on interest-bearing accounts, reduced rates of interest on financings, and minimized charges for services such as overdraft accounts or ATM use.

Unlike lots of banks that prioritize profits for investors, government lending institution are not-for-profit organizations that exist to serve their participants. Cheyenne Credit Unions. This distinction in structure allows cooperative credit union to pass on extra desirable rates and costs to their members. Additionally, cooperative credit union are commonly able to offer even more tailored services to help members navigate their financial needs while keeping prices reduced

Area Involvement and Assistance

A significant element of federal cooperative credit union is their dedication to community participation and support, showing a dedication to serving not only their participants but likewise the broader neighborhood neighborhood. Federal lending institution frequently participate in different community initiatives, such as economic education and learning programs, philanthropic contributions, and volunteering efforts. By actively taking part in these activities, lending institution enhance their bond with the community and add to its overall wellness.

Additionally, federal credit rating unions often take part in neighborhood charitable events and enroller area activities. Whether it's supporting a regional food drive, sponsoring a neighborhood occasion, or partnering with a charitable company, lending institution play an important function in giving back to the communities they serve. This dedication to area participation sets government cooperative credit union apart and highlights their dedication to making a positive impact beyond simply banking solutions.

Electronic Banking Convenience

Enhancing banking availability via on-line solutions has come to be Wyoming Federal Credit Union a keystone of contemporary monetary establishments. Federal debt unions master providing members with convenient electronic banking choices that provide to their varied demands. Via user-friendly user interfaces, protected systems, and a variety of solutions, members can experience a smooth financial experience from the convenience of their homes or on the move.

Electronic banking ease provides participants the versatility to manage their financial resources 24/7, inspect account equilibriums, transfer funds in between accounts, pay expenses electronically, and set up automated payments. These features encourage people to have better control over their financial activities and make notified choices in actual time. Furthermore, digital declarations and alerts guarantee that participants remain up-to-date with their account details promptly.

Additionally, lots of federal cooperative credit union provide mobile banking applications that further enhance the financial process. These applications supply included ease by permitting members to down payment checks from another location, locate ATMs, and receive account informs on their smart devices. By embracing on-line financial services, government credit rating unions proceed to focus on member contentment and adjust to the advancing requirements of the electronic age.

Final Thought

Finally, signing up with a federal cooperative credit union provides countless benefits, including personalized client service, affordable prices and charges, area involvement, and convenient on-line financial choices (Credit Unions Cheyenne WY). By becoming a member of a federal cooperative credit union, individuals can appreciate a more fulfilling banking experience with lower fees, better lending prices, and higher financial savings passion. On the whole, federal credit report unions supply an one-of-a-kind opportunity for individuals to raise their banking experience and obtain customized economic solutions

Federal Credit score Unions offer an unique approach to financial that prioritizes member fulfillment and economic well-being.In Addition, Federal Debt Unions prioritize their participants' financial wellness over optimizing revenues.Experiencing personalized client solution at a Federal Credit scores Union enhances the total financial relationship for members. Unlike traditional banks, Federal Credit report Unions focus on constructing strong links with their participants by supplying personalized assistance customized to individual financial requirements. When you stroll into a Federal Credit Report Union, you are more than just an account number; you are a valued member of a community-focused economic organization.

Report this page